FIN 565 Week 7 Homework

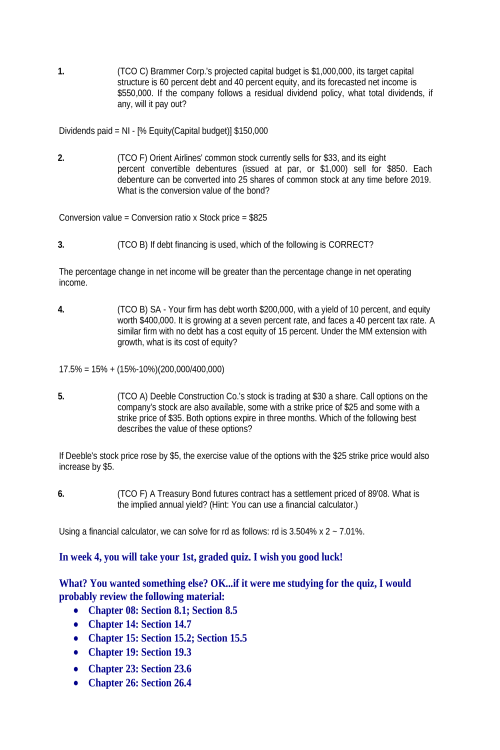

Chapter 19 Banker’s Acceptances Describe how foreign trade would be affected if banks did not provide trade- related services. Foreign trade would be reduced without the trade-related services by banks, because some trade can only occur if banks back the transaction with banker’s acceptances. How can a banker’s acceptance be beneficial to an exporter, an importer, and a bank? A banker’s acceptance guarantees payment to the exporter so that credit risk of the importer is not worrisome. It allows the importers to import goods without being turned down due to uncertainty about their credit standing. It is a revenue generator for the bank since a fee is received by the bank for this service. Letters of Credit Ocean Traders of North America is a firm based in Mobile, Alabama, that specializes in seafood exports and commonly uses letters of credit (L/Cs) to ensure payment. It recently experienced a problem, however. Ocean Traders had an irrevocable L/C issued by a Russian bank to ensure that it would receive payment upon shipment of 16,000 tons of fish to a Russian firm. This bank backed out of its obligation, however, stating that it was not authorized to guarantee commercial transactions. Explain how an irrevocable L/C would normally facilitate the business transaction between the Russian importer and Ocean Traders of North America (the U.S. exporter). The letter of credit