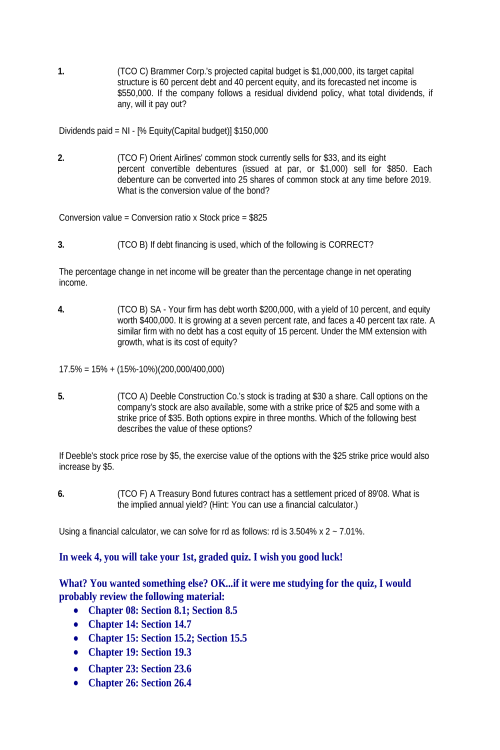

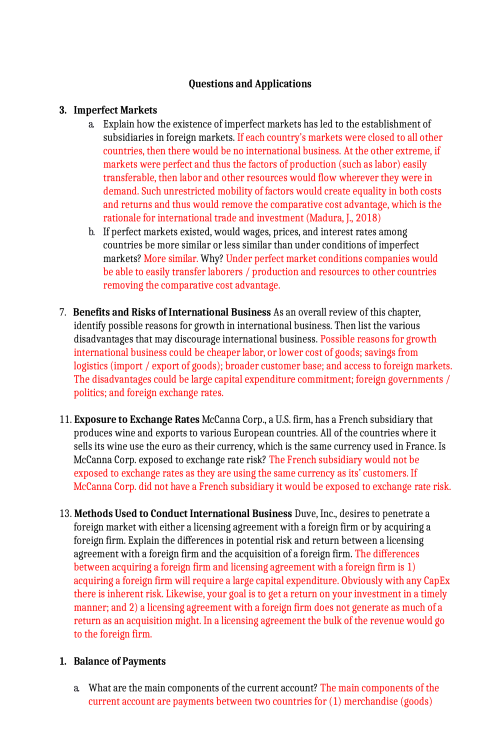

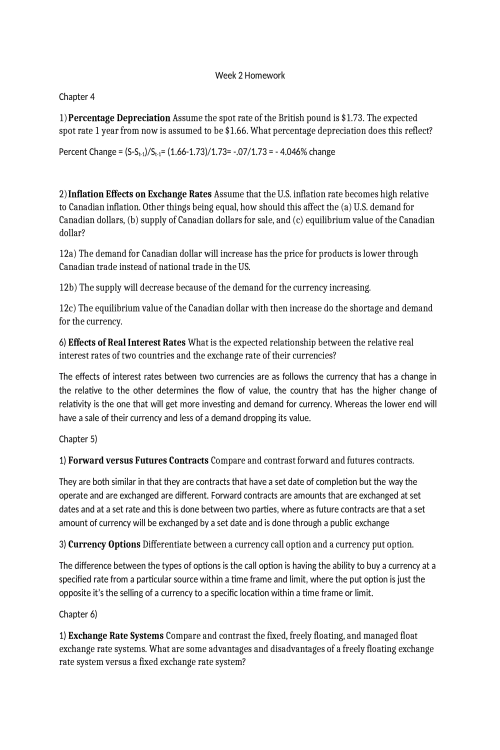

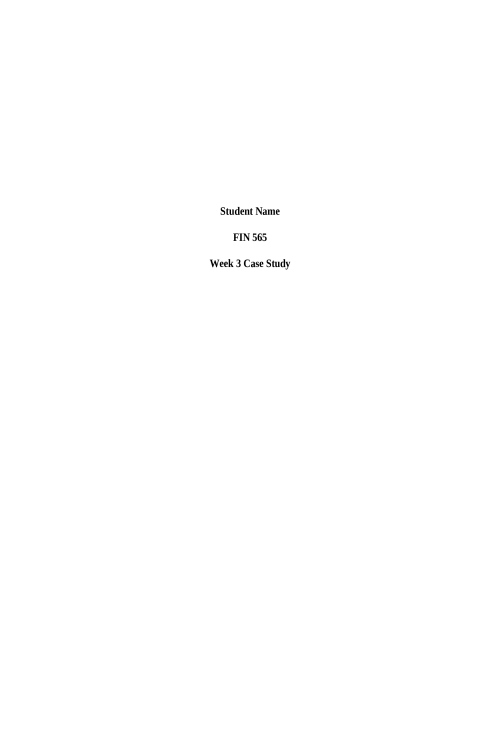

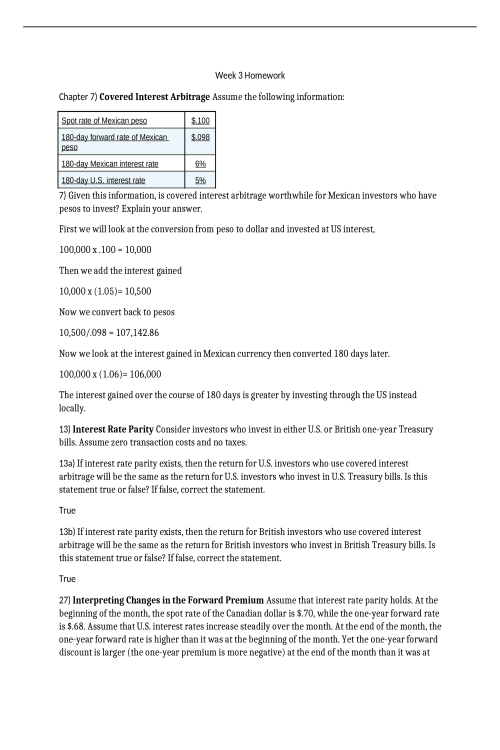

FIN 565 Week 4 Homework Questions and Applications

Questions and Applications Sources of Supplies and Exposure to Exchange Rate Risk Laguna Co. (a U.S. firm) will be receiving 4 million British pounds in one year. It will need to make a payment of 3 million Polish zloty in one year. It has no other exchange rate risk at this time. However, it needs to buy supplies and can purchase them from Switzerland, Hong Kong, Canada, or Ecuador. Another alternative is that it could also purchase one-fourth of the supplies from each of the four countries mentioned in the previous sentence. The supplies will be invoiced in the currency of the country from which they are imported. Laguna Co. believes that none of the sources of the imports would provide a clear cost advantage. As of today, the dollar cost of these supplies would be about $6 million regardless of the source that will provide the supplies. The spot rates today are as follows: British pound = $1.80 Swiss franc = $.60 Polish zloty = $.30 Hong Kong dollar = $.14 Canadian dollar = $.60 The movements of the pound and the Swiss franc and the Polish zloty against the dollar are highly correlated. The Hong Kong dollar i