FIN 516 Week 7 Homework

$10

Contributor

Amanda

Category

Finance

Course

FIN 516 Advanced Managerial Finance

Institute

DeVry

Pages

2

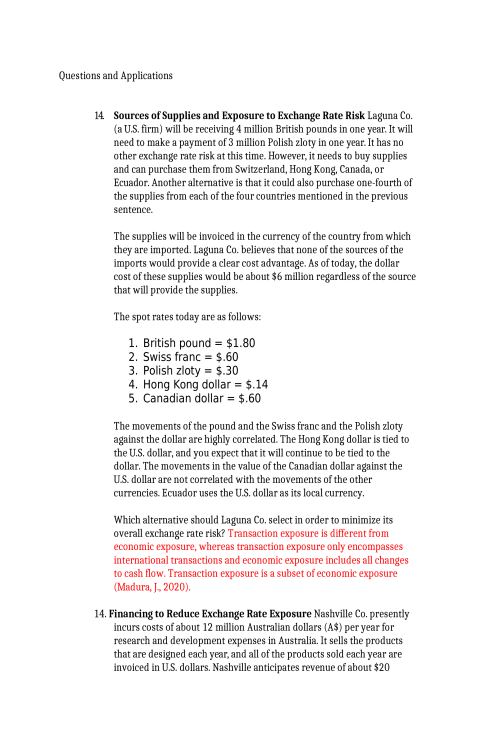

Problem 31-1 on Exchange Rates based on Chapter 31 International Corporate Finance (Excel file included) You are a U.S. investor who is trying to calculate the present value of a €5 million cash inflow that will occur 1 year in the future. The spot exchange rate is S = $1.25/€ and the forward rate is F1 = $1.215/€. You estimate that the appropriate dollar discount rate for this cash flow is 4% and the appropriate euro discount rate is 7%. What is the present value of the €5 million cash inflow computed by first discounting the euro and then converting it into dollars? PV= (5 million / 1 + .07) X 1.25 = $5.841121.50 million = $5.84 million What is the present value of the €5 million cash inflow computed by