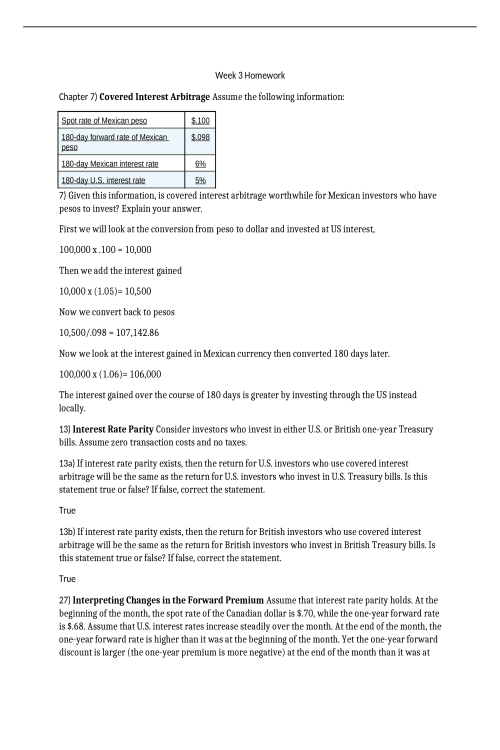

FIN 565 Week 2 Homework

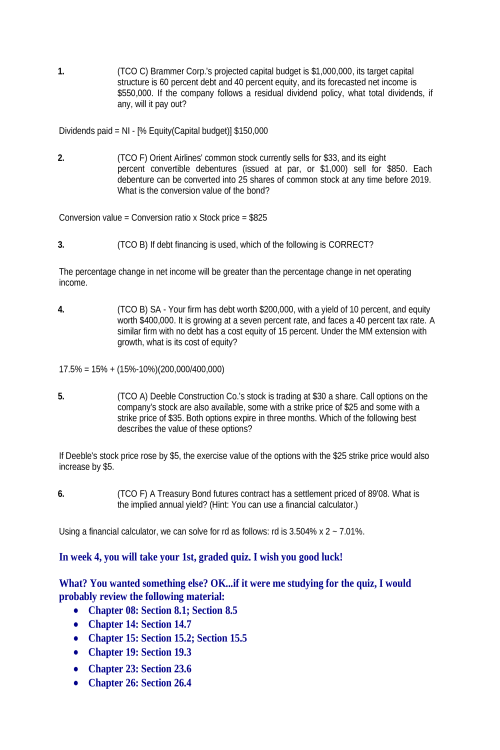

Week 2 Homework Chapter 4 Percentage Depreciation Assume the spot rate of the British pound is $1.73. The expected spot rate 1 year from now is assumed to be $1.66. What percentage depreciation does this reflect? Percent Change = (S-St-1)/St-1= (1.66-1.73)/1.73= -.07/1.73 = - 4.046% change Inflation Effects on Exchange Rates Assume that the U.S. inflation rate becomes high relative to Canadian inflation. Other things being equal, how should this affect the (a) U.S. demand for Canadian dollars, (b) supply of Canadian dollars for sale, and (c) equilibrium value of the Canadian dollar? 12a) The demand for Canadian dollar will increase has the price for products is lower through Canadian trade instead of national trade in the US. 12b) The supply will decrease because of the demand for the currency increasing. 12c) The equilibrium value of the Canadian dollar with then increase do the shortage and demand for the currency. 6) Effects of Real Interest Rates Wha