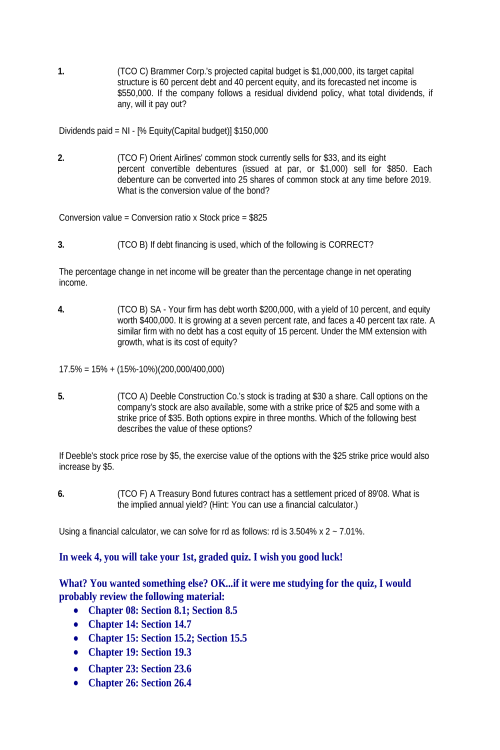

FIN 565 Week 6 Homework

Chapter 15 Pricing a Foreign Target Alaska, Inc., would like to acquire Estoya Corp., which is located in Peru. In initial negotiations, Estoya has asked for a purchase price of 1 billion Peruvian new sol. If Alaska completes the purchase, it would keep Estoya’s operations for two years and then sell the company. In the recent past, Estoya has generated annual cash flows of 500 million new sol per year, but Alaska believes that it can increase these cash flows 5 percent each year by improving the operations of the plant. Given these improvements, Alaska believes it will be able to resell Estoya in two years for 1.2 billion new sol. The current exchange rate of the new sol is $.29, and exchange rate forecasts for the next two years indicate values of $.29 and $.27, respectively. Given these facts, should Alaska, Inc., pay 1 billion new sol for Estoya Corp. if the required rate of return is 18 percent? What is the maximum price Alaska should be willing to pay? 914400167904952500974354 NPV=-1000*0.29++=191.19>0 2106929-6025753572509-6025751436369276264227457027626431445202762643385820276264510920927626453517792762645533390276264S=0.29,=0.29, (1+)(1+f)=(1+) , (1+0.29)*(1+0.27)= (1+) ,=0.28 Alaska should buy Estoya Corp. with 1 billion and the maximum price Alaska should be willing to pay is 481.19 million dollars (Letting NPV=0) Alaska, Inc. should not pay more than $468.62 million for Estoya Corp. Estoya is asking for 1.2 billion new sol, which translates to $348 million at the current exchange rate of $.29. Therefore, Alaska, Inc. should purchase Estoya Corp. Feasibility of a Divestiture Merton, Inc., has a subsidiary in Bulgaria that it fully finances with its own equity. Last week, a firm offered to buy the subsidiary from Merton for $60 million in cash, and the offer is still available this week as well. The annualized long-term risk-free rate in the United States increased from 7 to 8 percent this week. The expected monthly cash flows to be generated by the subsidiary have not changed since last week. The risk premium that Merton applies to its projects in Bulgaria was reduced from 11.3