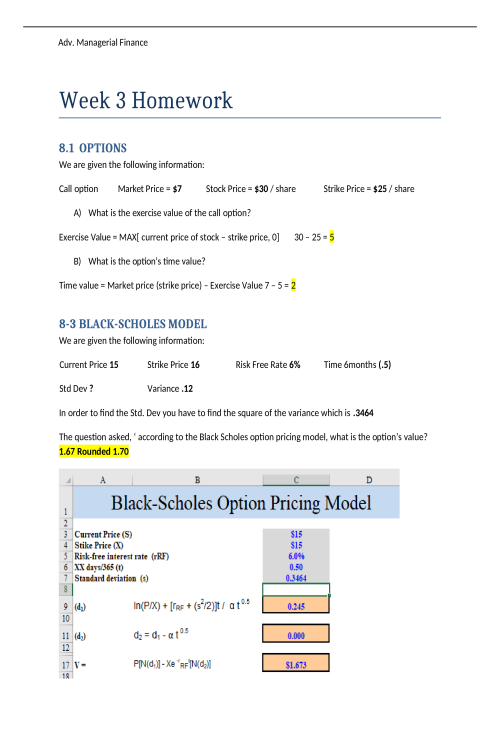

FIN 565 Week 3 Homework

Week 3 Homework Chapter 7) Covered Interest Arbitrage Assume the following information: Spot rate of Mexican peso $.100 180-day forward rate of Mexican peso $.098 180-day Mexican interest rate 6% 180-day U.S. interest rate 5% 7) Given this information, is covered interest arbitrage worthwhile for Mexican investors who have pesos to invest? Explain your answer. First we will look at the conversion from peso to dollar and invested at US interest, 100,000 x .100 = 10,000 Then we add the interest gained 10,000 x (1.05)= 10,500 Now we convert back to pesos 10,500/.098 = 107,142.86 Now we look at the interest gained in Mexican currency then converted 180 days later. 100,000 x (1.06)= 106,000 The interest gained over the course of 180 days is greater by investing through the US instead locally. 13) Interest Rate Parity Consider investors who invest in either U.S. or British one-year Treasury bills. Assume zero transaction costs and no taxes. 13a) If interest rate parity exists, then the return for U.S. investors who use covered intere