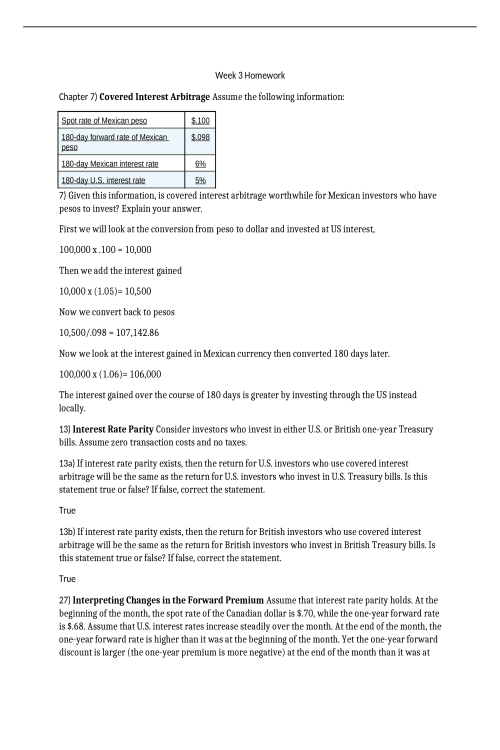

FIN 516 Week 8 Final Exam.

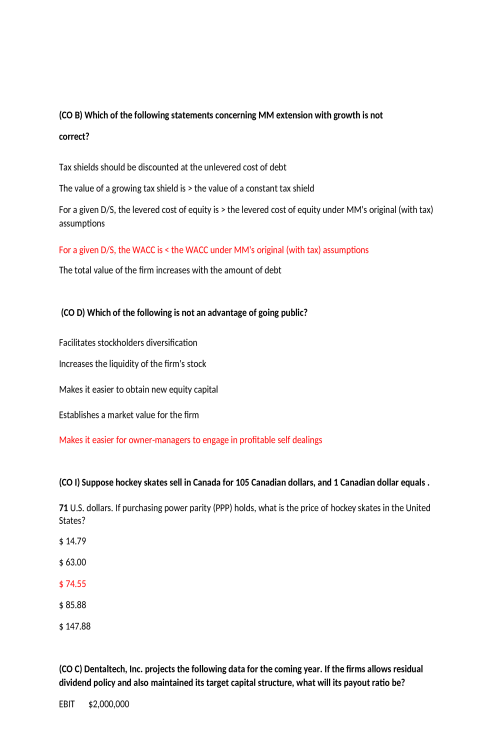

Question 1 20 / 20 pts (CO B) Which of the following statements concerning MM extension with growth is not correct? 924560145531 The tax shields should be discounted at the cost of debt 924560149296 The value of a growing tax shield is > the value of a constant tax shield 924560149296 For a given D/S, the levered cost of equity > the levered cost of equity under MM's original (with tax) assumptions 923925159385 For a given D/S, the WACC is > the WACC under MM's original (with tax) assumptions 924560226695 The total value of the firm increases with the amount of debt Question 2 20 / 20 pts (CO D) Which of the following statements is most correct? 924560145516 In a private placement, securities are sold to private (individual) investors rather than to institutions 924560120088 Private placements occur most frequently with stocks, but bonds can also be sold in a private placement 924560120088 Private placements are convenient for issuers, but the convenience is offset by higher floatation costs The SEC requires that all private placements be handled by a registered banker 924560120042 Private placements generally can bring in funds faster than is the case with public offerings Answer is: e Chapter 18 Question 3 20 / 20 pts (CO I) Suppose in the spot market 1 U.S. dollar equals 1.60 Canadian dollars. Six month Canadian securities have an annualized return of 6% (and thus a 6-month periodic return of 3%)