FIN 516 Week 3 Homework

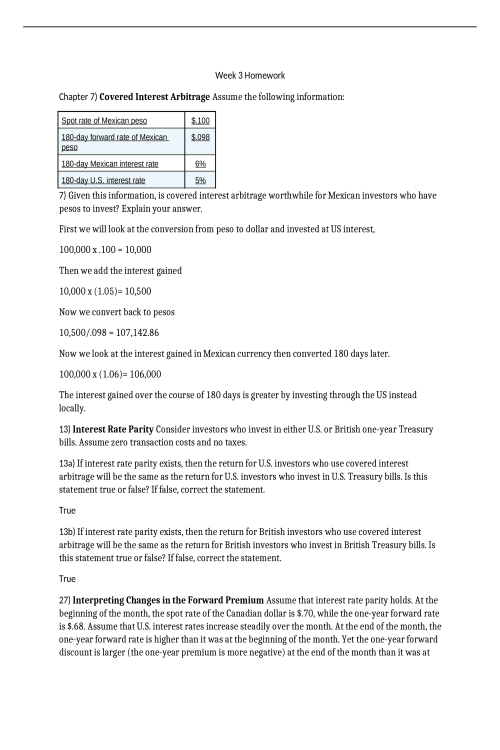

Week 3 Homework OPTIONS We are given the following information: Call optionMarket Price = $7Stock Price = $30 / shareStrike Price = $25 / share What is the exercise value of the call option? Exercise Value = MAX[ current price of stock – strike price, 0]30 – 25 = 5 What is the option’s time value? Time value = Market price (strike price) – Exercise Value 7 – 5 = 2 8-3 BLACK-SCHOLES MODEL We are given the following information: Current Price 15 Strike Price 16 Risk Free Rate 6% Time 6months (.5) Std Dev ? Variance .12 In order to find the Std. Dev you have to find the square of the variance which is .3464 The question asked, ‘ according to the Black Scholes option pricing model, what is the option’s value? 1.67 Rounded 1.70 914400150750 8-5 BLACK-SCHOLES MODEL We are giv